SOAR Market Future Scope and Strategic Developments

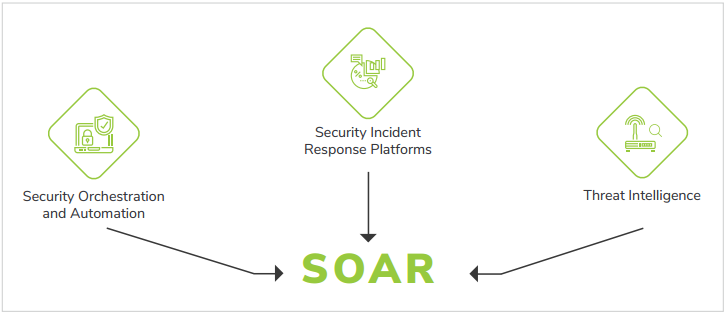

Attractive investment opportunities emerge within security orchestration market as evolving threats and technologies create new demand segments. The Security Orchestration Automation and Response (SOAR) Market Opportunities analysis identifies high-growth segments where innovative vendors can capture significant market positions through differentiation. Artificial intelligence-enhanced automation represents major opportunity as organizations seek intelligent threat response capabilities. The Security Orchestration Automation and Response (SOAR) Market size is projected to grow USD 8.266 Billion by 2035, exhibiting a CAGR of 10.52% during the forecast period 2025-2035. Cloud-native SOAR platforms capture growing demand as organizations migrate security operations to cloud environments. Managed SOAR services address persistent talent shortages through outsourced automation operations delivery. Mid-market segment expansion creates opportunity through simplified affordable solutions addressing underserved customers. Vertical specialization enables differentiation through industry-specific automation content and compliance frameworks.

Technology innovation creates opportunities for vendors developing next-generation orchestration capabilities addressing emerging requirements comprehensively. Generative artificial intelligence integration enables natural language playbook creation democratizing automation development substantially. Autonomous response capabilities address requirement for faster threat containment without human intervention delays. Extended detection and response integration opportunities expand platform scope addressing broader security operations needs. Predictive automation capabilities anticipate threats enabling proactive response before attacks materialize completely. Privacy automation opportunities address evolving regulatory requirements through automated data handling procedures. Cloud security automation opportunities address configuration management at scale across multi-cloud environments. Software supply chain security automation addresses emerging threats targeting development pipeline integrity. Zero trust automation opportunities support continuous verification architectures requiring dynamic access decisions. Operational technology automation opportunities address industrial control system security requirements specifically. Cross-platform automation opportunities enable consistent response across diverse technology environments.

Geographic expansion creates opportunities for vendors entering high-growth regional markets with orchestration solutions strategically. Asia Pacific opportunities expand rapidly as enterprises modernize security operations addressing regional threats. Middle Eastern opportunities grow as organizations protect critical infrastructure from sophisticated threat actors. Latin American opportunities increase as organizations recognize security automation importance amid threats. African opportunities emerge as cybersecurity maturity increases across the continent's enterprises. Southeast Asian opportunities expand as regional economic growth drives security investment increases. Indian opportunities grow substantially as enterprises address talent shortages through automation adoption. Eastern European opportunities increase as regional security awareness elevates automation priorities. Gulf region opportunities develop as energy sector organizations enhance security automation capabilities. Australian opportunities expand addressing regulatory requirements and operational efficiency objectives. Nordic opportunities grow as enterprises seek automation addressing sophisticated threat landscapes.

Partnership and acquisition opportunities enable accelerated market entry and capability development for strategic investors. Technology vendor acquisitions provide immediate capability access for organizations seeking market entry positions. Regional player acquisitions enable geographic expansion bypassing organic market development timeline requirements. Talent acquisitions address critical skill shortages through organized security automation team additions. Customer base acquisitions provide immediate revenue and market position through installed base ownership. Intellectual property acquisitions secure competitive advantages through patent and technology ownership claims. Joint venture opportunities enable market entry with reduced risk through local partner relationships. Licensing opportunities provide revenue diversification through technology monetization across additional channels. Distribution partnership opportunities extend market reach without direct sales investment requirements substantially. Technology partnership opportunities enable capability extension through complementary vendor relationship development. Research collaboration opportunities advance innovation through academic and industry cooperation arrangements.

Top Trending Reports -

Europe Transaction Monitoring Market Segmentation

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness